Ujjivan Small Finance Bank for the quarter ended September 30, 2023.

Key Business Highlights for the Quarter ended September 30, 2023:

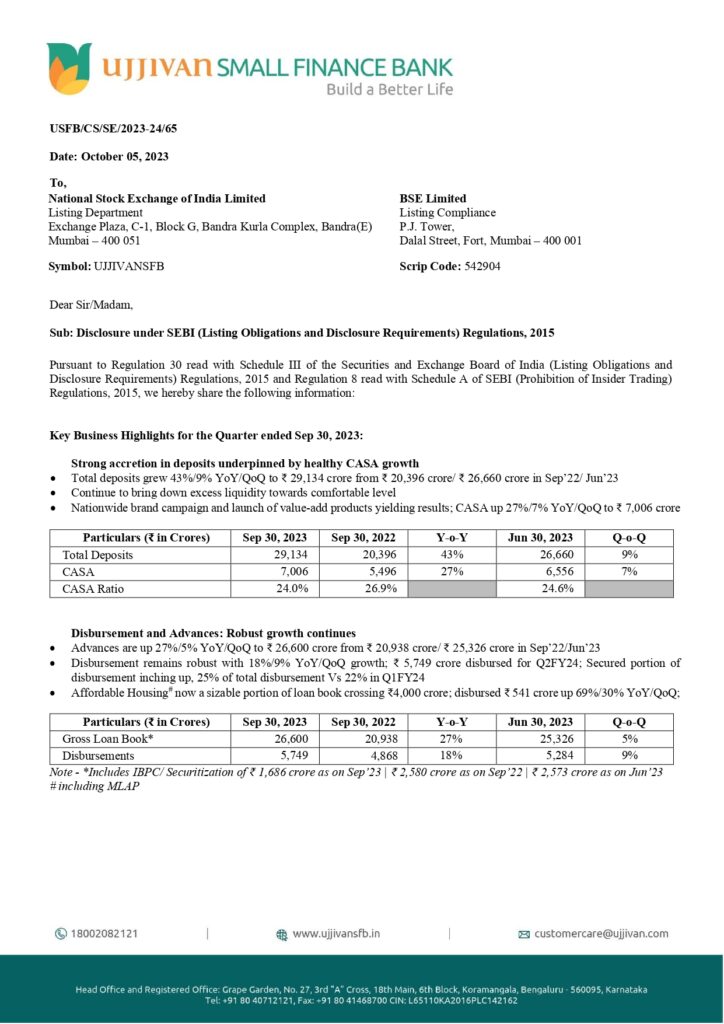

Strong accretion in deposits underpinned by healthy CASA growth

- Total deposits grew 43%/9% YoY/QoQ to ₹ 29,134 crore from ₹ 20,396 crore/ ₹ 26,660 crore in Sep’22/ Jun’23

- Continue to bring down excess liquidity towards comfortable level

- Nationwide brand campaign and launch of value-add products yielding results; CASA up 27%/7% YoY/QoQ to ₹ 7,006 crore

Disbursement and Advances: Robust growth continues

- Advances are up 27%/5% YoY/QoQ to ₹ 26,600 crore from ₹ 20,938 crore/ ₹ 25,326 crore in Sep’22/Jun’23

- Disbursement remains robust with 18%/9% YoY/QoQ growth; ₹ 5,749 crore disbursed for Q2FY24; Secured portion of disbursement inching up, 25% of total disbursement Vs 22% in Q1FY24

- Affordable Housing# now a sizable portion of loan book crossing ₹4,000 crore; disbursed ₹ 541 crore up 69%/30% YoY/QoQ

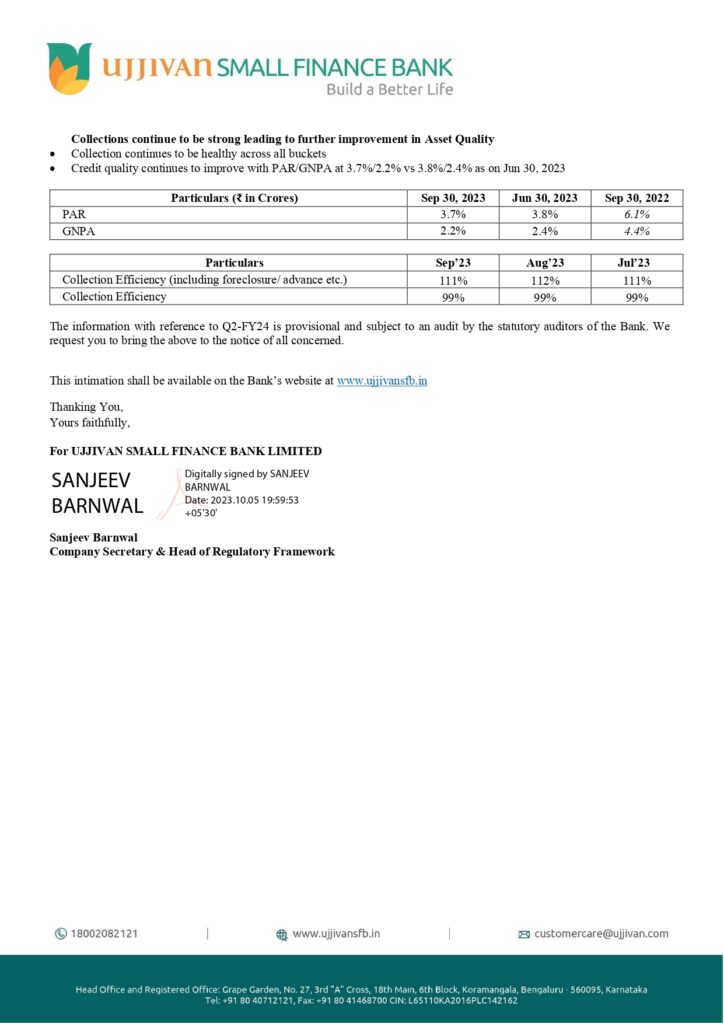

Collections continue to be strong leading to further improvement in Asset Quality

- Collection continues to be healthy across all buckets

- Credit quality continues to improve with PAR/GNPA at 3.7%/2.2% vs 3.8%/2.4% as on Jun 30, 2023