OYO launches its premium resorts brand ‘Palette’

Palette – Coastal Grand Hotels & Resorts, Chennai

Chennai: Global hospitality technology company OYO has entered premium resorts and hotels category with the launch of its new brand-Palette. Similar to the various colours on a ‘palette’, the company has curated a range of upscale resorts and hotels for travellers seeking a premium experience at competitive prices.

The move comes as a part of OYO’s ongoing efforts to make its premium property portfolio more versatile. Palette resorts will be strategically located in popular leisure destinations across India, while also catering to business leisure or bleisure travellers looking for quick getaways and staycations.

Owing to the rise of middle class and higher disposable income, luxury hotels and resorts segment is witnessing an unprecedented growth in India. Urban millennials and GenZ today are seeking more authentic and unique experiences, and don’t mind spending extra to attain the same. As per a recent FICCI report, Indian luxury hospitality market has projected an annual growth rate of 12.8 % between 2015 and 2025. The pan-India premium hotel occupancy will witness a decadal high of 70-72% in FY2024, as per ICRA……………………………………………………………………………………………………

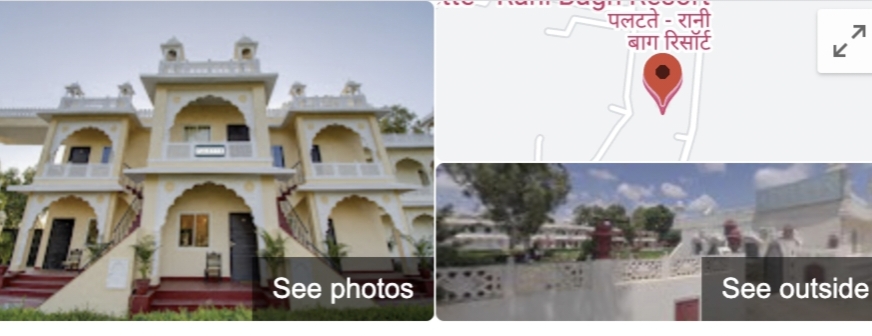

Palette – Rani Bagh Resort, Jaipur

In tandem with this, the Palette category has been curated keeping mind the evolving needs of new age travellers. From elegantly designed rooms and serene spaces to fine dining experiences and recreational activities, Palette resorts are equipped with all modern amenities for a rejuvenating experience.

OYO has started 10 Palette resorts as a pilot in cities like Jaipur, Hyderabad, Digha, Mumbai, Chennai, Manesar and Bangalore. The company will add 40 more Palette resorts to its portfolio by Q2 FY 2024. The expansion will encompass destinations like Delhi-NCR, Kolkata, Amritsar, Shimla, Goa, Udaipur, Pune, Mussoorie, Srinagar and Kochi.

Elaborating on the plan, Anuj Tejpal, Chief Merchant Officer, OYO said, “Today, travellers are seeking more than just a place to stay; they are craving unique and memorable experiences. This paradigm shift, fuelled by rising disposable incomes, has prompted us diversify our portfolio and introduce Palette brand. We have seen a very encouraging response for the existing 10 properties and the addition of new destinations will help us in having a more holistic portfolio for our guests’”

Commenting on his association with OYO, Arun Elango, Owner, Palette – Coastal Grand Hotels & Resorts said: “I am delighted to be a part of this exciting new venture by OYO- it has been a very positive and enriching experience so far. The partnership has helped me in showcasing the uniqueness of my resort while benefitting from the extensive reach and operational expertise of OYO. It has been instrumental in elevating the quality of service and experiences we offer to our guests. I am excited about the future and prospects that this partnership holds.”

Other premium brands under OYO’s umbrella include names such as Townhouse Oak, OYO Townhouse, Collection O, and Capital O. The company is planning to add 1800 new properties to its premium portfolio by the end of 2023.

OYO hotels can be booked through a simple three click booking process on OYO Hotels app. Customers choose OYO’s platform for many reasons, including accessibility to hotels at competitive prices, quality accommodation, ease of use of the app, personalization, and flexibility of the platform. Customers can also resolve their queries quickly with OYO’s 24*7 chatbot – Yo! Chat.

About OYO

OYO is a global platform that aims to empower entrepreneurs and small businesses with hotels and homes by providing full-stack technology products and services that aim to increase revenue and ease operations, bringing easy-to-book, affordable, and trusted accommodation to customers around the world. OYO offers 40+ integrated products and solutions to patrons who operate over 168,711 hotel and home storefronts in more than 35 countries including India, Europe and Southeast Asia, as of September 30, 2022. For more information, visit – https://www.oyorooms.com/

Disclaimer: Oravel Stays Limited is proposing, subject to applicable statutory and regulatory requirements, receipt of requisite approvals, market conditions and other considerations, to make an initial public offering of its equity shares (the “Equity Shares”) and has filed the Draft Red Herring Prospectus (“DRHP”) with the Securities and Exchange Board of India (“SEBI”).

The DRHP is available on the website of SEBI at www.sebi.gov.in, websites of the Stock Exchanges, i.e., BSE Limited and National Stock Exchange of India Limited at www.bseindia.com and www.nseindia.com, respectively, and is available on the websites of the Global Coordinators and Book Running Lead Managers, i.e., Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited and Citigroup Global Markets India Private Limited at www.investmentbank.kotak.com, www.jpmipl.com and www.online.citibank.co.in/rhtm/citigroupglobalscreen1.htm; the websites of the Book Running Lead Managers, i.e., ICICI Securities Limited, Nomura Financial Advisory and Securities (India) Private Limited, JM Financial Limited and Deutsche Equities India Private Limited at www.icicisecurities.com, www.nomuraholdings.com/company/group/asia/india/index.html, www.jmfl.com and www.db.com/India, respectively. Investors should note that investment in equity shares involves a high degree of risk and for details relating to the same, refer to the Red Herring Prospectus which may be filed with the Registrar of Companies in the future, including the section titled “Risk Factors”. Potential investors should not rely on the DRHP filed with SEBI for making any investment decision. The Equity Shares offered in the Fresh Issue (as defined in the DRHP) and the Offer for Sale (as defined in the DRHP) have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) and, may not be offered or sold within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. Accordingly, the Equity Shares are only being offered and sold (i) within the United States only to “qualified institutional buyers” (as defined in Rule 144A under the Securities Act) in transactions exempt from, or not subject to, the registration requirements under the Securities Act, and (ii) outside the United States in offshore transactions in reliance on Regulation S under the Securities Act and pursuant to the applicable laws of the jurisdictions where those offers and sales are made. There will be no public offering of the Equity Shares in the United States.